The Central African Republic plans to become a crypto hub. By Christoph Bergmann

President Faustin-Archange Touadera recently announced an initiative to turn the Central African Republic (CAR) into the first legal crypto hub in Africa. This, he claims on Twitter, “goes beyond politics and administration and has the potential to reshape the CAR’s financial system.”

Indeed, the plan seems quite far-reaching – and it contains some geopolitical explosives. Will crypto help the poor country free itself from the monetary chains of colonialism? Or does it merely serve the president to sell off the country’s rich raw materials?

The name of the new crypto initiative is Sango, which is also the official language of the CAR. On the website sango.org, a presentation describes the project. It remains rather vague, but it does sound ambitious. The plan contains all buzzwords the crypto world has to offer: Bitcoin, altcoins, tokens, ICOs, the Metaverse, NFTs, you name it. If executed well, Sango is nothing less than an attack on Central Africa’s current monetary order. It looks like the CAR’s initiative might cause a currency war. We will come to that later, let’s first have a look at Sango’s main components.

The initiative will establish a crypto hub, which welcomes businesses and attracts crypto enthusiasts worldwide. It is based on a new legal framework, a digitalised administration, tax exemptions and public-private partnerships. It will create the first ever digital central bank and a crypto economic zone called “Crypto Island”, both in the real world and in a virtual metaverse, where NFTs represent goods and privileges. Furthermore, the government will sell land and mineral resources for Bitcoin.

All this has become possible through a new crypto law that was passed on the 21st of April, 2022. The rest of the legal framework will be created by the end of 2022.

Does the World Bank Pay for it?

The presentation also mentions a 35-million-dollar loan that the World Bank granted the country. The announcement of the world bank praises the Central African Republic’s progress in digitising its financial sector. The World Bank’s partnership with the country has the central goal of improving “public financial management, transparency and efficiency”, as well as “creating new job opportunities for young people”.

One would think that the Central African Republic is doing just that with its Sango initiative. Not even the world bank can doubt that crypto is the most transparent and efficient financial management system available. But when rumours spread that the most important institution of the legacy system funds a crypto project, the World Bank denied that it had anything to do with it. On the contrary, it is watching the project with scepticism: “We have concerns regarding transparency as well as the potential implications for financial inclusion, the financial sector and public finance at large, in addition to environmental shortcomings,” the World Bank said according to a Bloomberg report.

Digitising Everything

Despite the criticism, the government of the CAR seems to be serious about digitising its administration. Blockchain technology is playing a key role in this. Identity documents, business registrations and property deeds are to be digitised; all offices have to recognise blockchain based titles. There are plans for an e-residency, following Estonia’s example. The idea is to make it easy to start a business in CAR without ever having to set foot in the country.

It seems that the Central African Republic is planning to establish itself as a tax haven. The Sango initiative promises tax exemptions on income, business and crypto trading profits. It is not clear yet whether this only applies to crypto companies, and only in the “Crypto Island” zone.

In addition, the government intends to use tokens and crypto-crowdfunding to finance public-private partnerships. One could imagine that private companies receive tokens which represent profits in infrastructure projects, perhaps toll revenues from roads or clearance fees from a port. ICOs may be used to fund such projects.

Even more attractive to foreign entrepreneurs might be another type of planned token that represents commodities and real estate being sold for Bitcoin. And that brings us to geopolitics.

Tokenising Resources

The Central African Republic has rich natural resources: gold, diamonds, uranium, iron ore, copper, coltan, cobalt, nickel, lithium, petroleum, graphite, ilmenite, kaolin, kyanite, lignite, manganese, quartz, rutile, salt and tin. However, most of these resources are not yet being exploited. Mining is mainly limited to gold and diamonds.

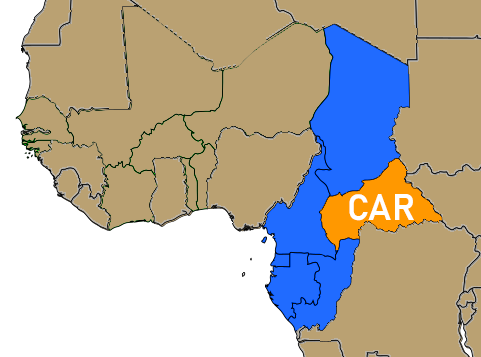

The country is sitting on an untapped treasure that is more valuable than ever in the current geopolitical situation in which resources are getting scarcer. The CAR is rich in raw materials without yet mining them. So far, the country has not been able to use its commodity wealth to raise the living standards of its people. In the list of gross national product per capita adjusted for purchasing power, the country ranks 226th out of 228. One reason for this are the civil wars that ravaged the country until Touadera’s first presidency in 2016.

The few commodities that are being mined, such as diamonds, do not benefit the population. This is due to widespread corruption and a very centralised market, in which many small entrepreneurs extract the raw materials, while only very few wholesalers distribute them.

With its cypto Initiative, the government wants to allow foreign entrepreneurs and investors to buy tokenised commodities which are still in the ground. Crypto whales may buy an yet untapped gold, copper or coltan mine and tokenise it. And of course they can invest in it with Bitcoin.

One might suspect that the government wants to abuse crypto in order to sell the country’s raw materials abroad. Cryptocurrencies and tokens definitely make it easier to sell resources. On the other hand, the Crypto initiative could decentralise and boost trade. These revenues may be invested in infrastructure, such as roads, ports or railways. If implemented successfully, Sango could become a blueprint for countries in a similar situation as the CAR.

A Digital Central Bank

Besides opening up to investors, the Crypto initiative has a very specific geopolitical component: The CAR plans to establish its own digital national bank, the Banque National Digitale de la Republique Centrafricaine.

This is challenging the post-colonial monetary order of Central Africa. So far, the CAR does not have its own central bank. Instead, the CAR, Cameroon, Chad, the Republic of Congo, Equatorial Guinea and Gabon all use a common currency, the CFA franc, which is issued by the Bank of Central African States (BEAC), based in Yaoundé, the capital of Cameroon. The BEAC plays a similar role in Central Africa as the European Central Bank (ECB) does in the Eurozone. The CFA franc is pegged to the euro at a ratio of 1:100. Before the introduction of the euro, the CFA franc was pegged to the national currency of France, the former colonial power of all states using the CFA Franc. In fact, the BEAC can be seen as a division of the ECB, which determines its monetary policy.

Some say that the CFA franc creates monetary stability in an unstable region because it ties its value to the euro. But it also establishes an unhealthy economic dependence on France and the EU.

“A Middle Finger to the French System”

In an article in the Financial Times, Hippolyte Fofack, the chief economist of the African Export-Import Bank, explains that the CFA franc keeps currencies in Central Africa artificially high. This helps foreign companies to skim off profits and local elites to go shopping in European capitals. But it prevents industrialisation because export prices are not competitive. Fofack welcomes the Central African Republic’s Bitcoin law as a means to counter the dominance of the CFA franc. Chris Maurice, the CEO of Yellow Card, an African crypto exchange, polemically calls the law “an extended middle finger to the French economic system.”

However, this move away from France, the Financial Times assumes, may invite other global powers, especially Russia. President Toudera is accused of fighting rebels in his country with the help of the notorious Wagner Group of Russian mercenaries. Some fear that the crypto law may help Russia to deepen its influence over the country.

The Empire Strikes Back

BEAC, the Bank of Central African States, is obviously not amused by the CAR’s crypto ambitions. Its governor Abbas Mahamat Tolli says that by passing its Crypto law, the CAR has violated the membership rules of the Economic and Monetary Community of Central Africa (CEMAC), which consists of the same states that use the CFA franc as legal tender. He thinks that the main objective of the law is to create a currency not controlled by the BEAC and thereby “jeopardise monetary stability”.

It became even clearer that the BEAC disapproves of the CAR’s initiative when on May 6th, the Banking Commission of Central Africa (COBAC) categorically banned all cryptocurrencies in the CEMAC zone. Paying with cryptocurrencies is now illegal, hodling, exchanging or managing them, too.

It seems that there is a currency war brewing in Central Africa, with Bitcoin in its centre.

Conclusion

At this stage, it is hard to decide how to judge the CAR’s initiative. Is President Touadera, who is a mathematician, emancipating his country through a brilliant move? Is the crypto law the greatest opportunity the CAR has had in decades?

Or is the president abusing the World Bank loan? Is he selling off land and resources abroad for Bitcoins that flow into the pockets of the country’s elite? Is he cramming the already scarce state assets down the throats of foreign speculators? Is he even trying to rip off speculators from around the world? We will follow up on this.

Christoph Bergmann is the editor of Bitcoinblog.de, Germany’s leading publication on cryptocurrencies. This article has been published there first in German. Translation and editing: Aaron Koenig