Can the Lightning Network solve Bitcoin’s scaling problem?

Although you can already pay with Bitcoin in several hundred thousand online stores and in a few thousand shops in the real world, Bitcoin is still far from being widely accepted. One reason for this is that the number of technically possible transactions of the Bitcoin network is currently only about five to seven per second – significantly less than the several thousand transactions per second that credit card companies such as Visa or Mastercard can handle.

This technical limitation and the rising number of Bitcoin transactions has occasionally led to longer waiting times and higher fees. Various teams of developers are therefore working to make the Bitcoin network more efficient. A promising solution for this is the Lightning Network, a second layer on top of Bitcoin which makes it much faster and cheaper.

The Lightning Network has been conceived by Joseph Poon and Thaddeus Dryja and was presented at a developer meeting in San Francisco in 2015. Since then, a number of implementations have been released, among others by Lightning Labs, Blockstream and Acinq. There are a number of Lightning wallets such as Phoenix, Muun, Breez, Eclair and Zap. You can already pay via Lightning in a number of marketplaces and in some computer games – and these transfers are indeed “as fast as lightning” and cost next to nothing.

Like Bitcoin, the Lightning Network is a protocol that defines how computers communicate with each other. It forms a second layer on top of the Bitcoin protocol. This reminds of the structure of the Internet, where the TCP/IP protocol tell computers how to connect and send data packets to each other, while the higher level HTTP protocol determines how hyperlinks, images, videos and other media files are being

managed.

The Internet only became popular after HTTP was invented in 1989 by Tim Berners-Lee, as the basis of the World Wide Web. With its easy-to-use links, images and videos, the WWW has turned the Internet from a specialist medium for scientists into the colourful multimedia network for everyone, without which we can hardly imagine our lives today.

I expect a comparable breakthrough from the Lightning Network. Its basic idea is that not every transaction has to be stored immediately in the blockchain, because this process is slow and expensive. Instead, many thousands of transactions are initially made off-chain, that means: outside the blockchain. In the first layer Bitcoin network, every single transaction, no matter how small, is sent to the entire Bitcoin network and checked by many miners simultaneously. This is a lenghty and not very efficient process.

The Lightning Network is based on the so-called payment channels, which have existed for quite a while. They are based on Bitcoin’s programmability. Every Bitcoin transaction can contain program code that determines, for example, who has to sign it and when it is made. Two users who often do business with each other, can use these programming features to set up a direct payment channel between them. Through these channels they may send an infinite number of transfers back and forth, at a very high speed and for free.

They can define an end point at which their channel will be closed, which may be one day, one week, one month or even longer. Only the start and end state of the payment channel are stored in the blockchain, so only two transactions which have a cost occur. These costs are divided by all transfactions in the channel – hundreds, thousands, even millions, so that the costs come down to almost zero.

However, there are only a few use cases in which such a direct payment channel between two users makes sense. For example, if I drink my coffee in the same café every morning and prefer to pay the equivalent of 30 cups via a payment channel upfront once a month. A small amount is then deducted each time I take a cup of coffee and credited to the café.

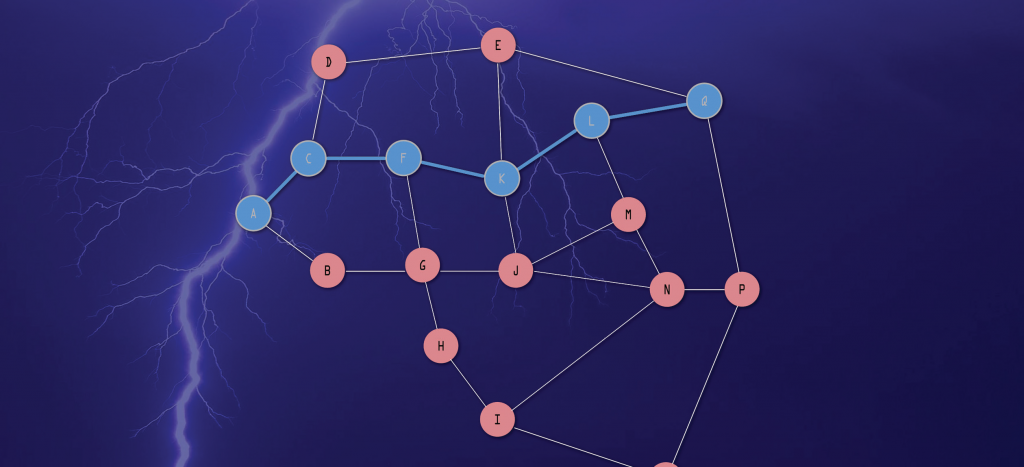

Many business relationships are not so regular that establishing a payment channel would be worth the effort. The idea of the Lightning Network is therefore to link many payment channels into one network in such a way that single transfers become possible. This requires a high amount of users being connected to each other via payment channels. A payment then uses several intermediate stations to find the shortest route from the payer to the recipient.

The Lightning Network routes payments in a similar way an email finds its way from the sender to the recipient via various Internet nodes. As with email, the normal user does not need to know how this happens, as long as his message arrives quickly and safely.

Lightning uses a method called Onion Routing, which means that each transaction is encrypted in such a way that every transaction only “knows” the nodes before and after it, as if it was wrapped in skins of an onion. In a Lightning transaction neither the original sender nor the recipient are known, which means that Lightning provides a much higher level of privacy than the original Bitcoin network.

It is important to understand that the operators of Lightning nodes do not have access to the users’ money. They are merely the intermediaries in the transfer process. As with blockchain transfers, there is no need to trust the Lightning Network nodes. The Lightning Network is decentralised by nature and it is based on the peer-to-peer principle.

However, it is foreseeable that there will be big Lightning Hubs which operate many payment channels simultaneously. They will finance the operation of the channel and receive fees in return.

As you may know, we are connected to every citizen of the earth by an average of six corners (i.e.: a friend of a friend of a friend of a friend of a friend of a friend of a friend …). With over eight billion people, this is a surprisingly small number. But it only works because there are people with a lot of acquaintances. These multi-contact persons provide many connections for all those who know them.

In the same way, we will probably see professional operators providing the majority of connections in the Lightning Network. They will not do this out of pure idealism, but they will finance their business through fees. Critics fear that the Lightning Network will be dominated by such middlemen, who are not supposed to exist in a pure peer-to-peer system.

They even envisage the horror scenario that the banks will take over the Bitcoin network. I think these accusations are exaggerated. In the Lightning Network there is no need to trust the middlemen. Surely there will be big Lightning Hubs, but this business opportunity is open to everyone. You don’t need a government licence to do so, as you need it to operate a bank. There will surely be a strong competition between Lightning Hubs, in which only those with the best customer service survive.

The fact that Bitcoin is now legal tender in El Salvador would be unthinkable without the Lightning Network. Bitcoin Beach could as well be called “Lightning Beach”, as only via the Lightning Network small payments for things like snacks or drinks are economically feasible.

The Lightning Network seems to be a very promising solution for scaling Bitcoin. There are still a number of unresolved issues. But I have no doubt that all those smart people who currently work on Lightning will find good solutions for them.

By Aaron Koenig