Is Bitcoin dead because of the current price drop? I don’t think so.

The price of Bitcoin has dropped drastically in the last weeks. From an All-Time-High of nearly 67,000 dollars in November 2021, it has fallen below 20,000 dollars. Bitcoin haters already proclaim the final death of decentralised money. Some Bitcoin newbies are worried about their losses or even panic-sell their coins.

If you have followed Bitcoin for a while, you know that there is absolutely no reason to panic. Similar movements of the Bitcoin price happened several times. In my eleven years in Bitcoin I have already observed four of these market cycles.

In June 2011 Bitcoin reached a peak of 30 dollars, went down to 2 dollars and reached that former All-Time-High again in early 2013. In November 2013 it peaked at around 1,100 dollars and fell down below 200 dollars. Bitcoin hodlers had to wait until early 2017 to see Bitcoin over 1000 dollars again. In November 2017, Bitcoin peaked close to 20,000 dollars and nosedived to around 3000 dollars, finally breaking the 20,000 dollar mark in December 2020.

The Bitcoin Halving

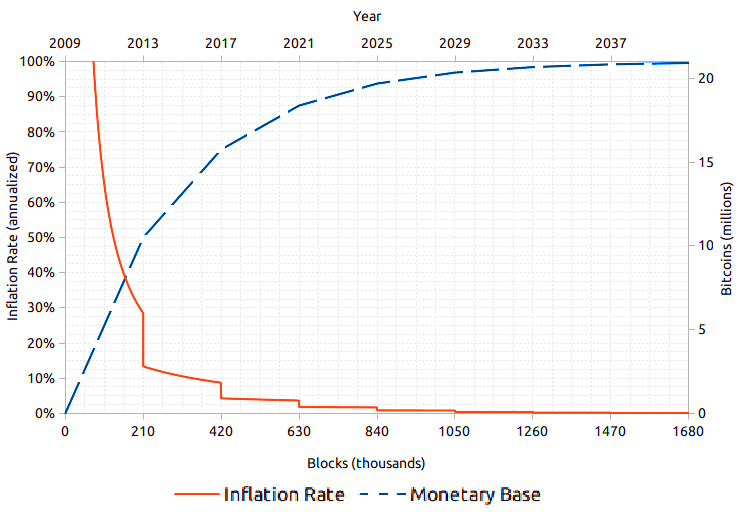

One can easily see a pattern here. The ups and downs of Bitcoin are closely connected to the halvings, which occur approximately every four years. Halving means that the amount of newly created Bitcoins which miners receive for running the Bitcoin network is cut in half.

In the first years, a Bitcoin miner who found a new block would receive 50 Bitcoins as a reward. This was reduced to 25 in November 2012, to 12.5 in July 2016 and to the current 6.25 in May 2020. Halvings are defined by the Bitcoin protocol and happen every 210,000 blocks, which usually takes a bit less than four years. The last three Bitcoin bull runs each started after a halving, reaching a new All-Time-High a few months later.

Only 32 halvings can happen until the final amount of around 21 million Bitcoins have come into existence. The last halving will probably be in the year 2140. Until then the supply of new Bitcoins is reduced in regular steps. Bitcoin does inflate, but not endlessly like Fiat money issued by central banks, but in a slow and predictable way.

Supply and Demand

As we know from basic economic lessons, the price of every good depends on its supply and demand. The Bitcoin supply is getting scarcer and scarcer, that is well known. It can be expected that the price of a good which behaves like Bitcoin appreciates. It is also no surprise that this happens in cycles, and this depends to a high degree on the demand.

It is not enough for a good to be scarce to have a high price, there need to be people who want to buy it. You only buy things that you consider useful. Bitcoin is undoubtedly very useful. In many aspects it is far superior to the current money system, which is based on a monopoly and therefore unfair by design. Bitcoin enables global payments from human to human, without borders and intermediaries.

However, it is still far from being the universal payment system it is designed to be. Bitcoin needs to become faster, cheaper, more private and more commonly used. The Lightning Network seems to be a good way to improve Bitcoin and make it more useful. If you buy Bitcoin today, you speculate on its future demand. Until it has reached global mass adoption, it is a speculative investment, and therefore influenced by all kinds of factors, most importantly the human psyche.

In these times of growing inflation, a looming economic crisis and the foreseeable end of the dollar’s dominance, Bitcoin would be a natural safe haven – if humans were completely rational beings. But we are not. Our behaviour depends to a high degree on our emotions. Most people haven’t understood Bitcoin’s potential yet and see it merely as a high risk investment, so they avoid it in critical times. That’s why its price falls, although a rise would be more logical.

How Useful Is Bitcoin?

The interesting question is not how the price of Bitcoin behaves in a short period of time, but how useful Bitcoin can really be in the long run. That is why the Hyperbitcoinizer does not cover the ups and downs of the market, but Bitcoin’s fundamentals and long term development.

We are interested in improving Bitcoin’s qualities as a payment system, e.g. through the Lightning Network. We are excited to see a whole new financial system built on decentralised technology such as Rootstock. We see the need for Bitcoin based stablecoins that are easy to use for merchants and buyers. We want to educate people about the real advantages of a monetary system that cannot be manipulated by the elites.

Innovations take time, especially when they threaten the beneficiaries of the current system. Banks and governments hate losing their power, so they do everything they can to fight decentralised, peer-to-peer money. They portray Bitcoin as either dangerous or useless, as a “ponzi scheme” or “responsible for climate change”, you name it. Better do your own research and don’t believe their lies.

Conclusion

Of course, there is no guarantee that the price of Bitcoin keeps on growing, just because it did so in the past. If demand for Bitcoin continues to rise, a new price rally will surely happen. However, if you only look at getting rich quickly by speculating with Bitcoin, you are missing the point. Bitcoin can only win over the monopoly system if we use it, spread it and make it better. Bear market times are good for buidlers!

If Bitcoin becomes better and more useful, it is very likely that its previous price patterns repeat and we will see a new Bitcoin bull run. If that happens, it will probably be shortly after the next halving, which will take place in early 2024.

Until then: don’t panic and help Bitcoin succeed.

By Aaron Koenig