And why you should better not believe the governments’ misleading definition of it

The official “inflation rate” has hit 8.6% in the USA and 8.1% in the Euro Zone – the highest published rates for decades. Some politicians blame Russia’s war against Ukraine and its effect on energy prices for this. But that is a blatant lie.

“Inflation is always and everywhere a monetary phenomenon.”, says Milton Friedman, economist and Nobel laureate. Ludwig Erhard, the former German chancellor and minister of economics, expresses it even more drastically: “Inflation does not come upon us as a curse or as a tragic fate; it is always caused by reckless or even criminal policies.”

The term inflation comes from the Latin verb inflare (to blow up), as we know it from inflatables. The original meaning in economics is the “blowing up” of the money supply by the central bank and the commercial banks. Both have the privilege to create money out of thin air. But most journalists, politicians and even economists do not use the word in this correct way, but merely as a synonym for “price increase rate”.

I think that this sloppy usage of language does not happen out of carelessness, but on purpose. The ones in power do not want us to understand the relation between the growth of the money supply and rising prices. We are made to believe that prices rise because of “the greed of capitalist companies” or the “evil deeds of a foreign tyrant”. The reason for this: The governments and the elites benefit from inflation at the expense of everybody else, that’s why they prefer to obfuscate the concept.

It is a basic economic law that the less scarce a good is, the cheaper it becomes. When the money supply increases more than the amount of goods and services, its purchasing power inevitably decreases. This is obvious in countries like Argentina, Venezuela or Zimbabwe, where the governments print more and more money to fund their expenses, which causes prices to rise weekly or even daily.

But seemingly stable economies like the USA or Germany do the same, just a little more gently. Even the FED’s official goal of a 2% increase of prices per year will lead to a 50% increase in the price level in 20 years. That means: in 2042 you would need 150 dollars to purchase the same basket of goods 100 dollars can buy today. Of course a price increase of more than 8% changes this significantly!

The official “inflation rate” that mainstream media present you is measured by a basket of selected goods and services. In Germany this basket contains more than 700 items, from fried sausage to women’s underwear, all meticulously weighted by government officials.

The interesting thing: Prices for company stocks or real estate are not included in this basket. They would spoil the show and make the “inflation rate” look ugly. Stocks and real estate usually rise much more in price than other things, because that is were the newly created money is being invested.

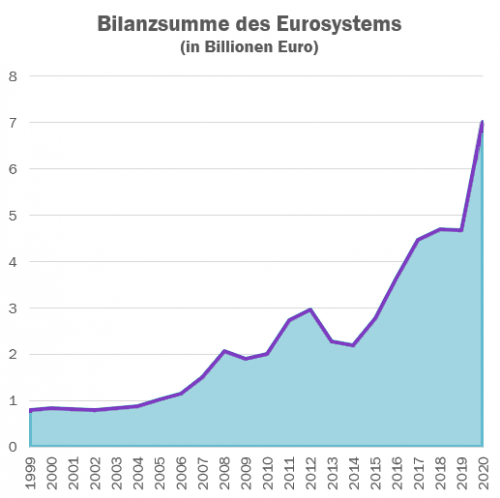

And there is A LOT of newly created money! The money supply in the USA has risen from around 10 trillion dollars to more than 20 trillion dollars from 2012 to 2022. The ECB’s balance sheet total has grown from around 3 trillion euros to more than 7 trillion euros in the same time period.*

That means: what we should call inflation, if we were using the term properly, is more than 100% in ten years. This is the real cause for the rising consumer prices people are suffering from today.

Inflation is like a hidden tax that harms people with low incomes the most. If your minister’s salary is paid by the government that can arbitrarily create new money, you don’t have to worry that much about rising food or petrol prices. People who receive normal salaries or pensions do!

This is called the Cantillon effect, named after the Irish-French economist Richard Cantillon (1680 – 1734). He found out that people who are close to the source of newly created money, such as government officials or bankers, benefit from inflation. Their money can buy goods and services still at the old prices before devaluation sets in, while workers and pensioners receive the money later, when prices have already risen.

In the last few years, average salaries have risen more slowly than prices. This is especially clear for house prices. In the USA, the price of buying a home has increased more than 3 times faster than the average income since 2008.

This is no surprise. Prices of consumer goods should actually go down because of higher productivity and sourcing out production to low wage countries. The fact that they rise despite this can be explained with monetary inflation.

But in real estate, rising productivity or globalisation cannot compensate for the true inflation effect. The rise of house prices reflects monetary inflation much more directly, and it leads to a lower standard of living for many people, who cannot afford to buy a house anymore.

Inflation, which we should understand as the “blowing up” of the money supply by banks and state institutions, is the real cause of the growing divide between the 1% elite and the rest of the population.

That’s why we need money with a strictly limited supply that cannot be manipulated by governments at the expense of the people.

That’s why we need Bitcoin.

By Aaron Koenig

* One billion in Europe equals one trillion in the USA